Feb 24, · Every good budget should include seven components: 1. Your estimated revenue This is the amount you expect to make from the sale of goods or services. It’s the cash you 2. Your fixed costs These are all your regular, consistent costs that don’t change according to how much you make—things 3 Components of a Business Budget. Again, a business budget is a key piece of your business plan (which you'll learn about more in the next course). It helps you determine how much money you need from investors and helps you prioritize your objectives. Components of a business budget you should think about include May 13, · Make a list of your fixed expenses. These ones repeat every month and their amount doesn’t change. Some people forget to exclude the sum needed to cover these expenses from the monthly income, but it’s important to do so in order to get a clear understanding of your budget. Don’t forget about variable blogger.comted Reading Time: 9 mins

Budgeting and business planning

Your business idea is fleshed out and your ducks are almost in a row. But there's one more component to your business plan that is essential to your overall pitch to investors which you'll learn about in the next section : your business budget.

It's critical to brainstorm your business budget before sitting down with anyone so you can get an idea of what you need to be successful. It's also important for strategically planning future projects and new hires. Again, a business budget is a key piece of your business plan which you'll learn about more in the next course. It helps you determine how much money you need from investors and helps you prioritize your objectives.

A good first step would be to decide which expenses are one-time expenses versus ongoing payments. It's tricky to determine how much something like payroll might cost when you're currently the only employee; but it's important to think about if you plan on expanding.

That's where research comes into play. Browse around business budgeting for a business plan and forums to get a sense of what startup expenses cost. There are also a number of calculating tools like Entrepreneur's Start Cost Calculator that can help you get a price estimate.

Estimating operational cost should be easier than startup costs. Your first step is to review bills you're already paying; for instance, for utilities and facilities. Take these amounts and tally the expenses for a year of payments. Also, note any transactional patterns from credit card statements, budgeting for a business plan. Estimating your business budget on day-to-day costs will help you reduce risk, budgeting for a business plan.

This could lead you to hold off moving in right away, and consider a more cost-effective work space short-term. Accounting software can help you take note of operational expenses by month in addition to helping you stay organized.

Putting together profit and revenue is tricky — but probably the most important part of your business idea. Investors aren't likely to fund your business if you can't provide the monetary value.

Budgeting for a business plan addition, estimating profit will help you plan for your business' long term growth. First, look at your product or service and estimate its price and how much you can sell per day, Things to take into consideration include:. Creating a budget will help you plan the beginning stages, run your business efficiently, and help you eventually grow. To make sure you have a successful brainstorm, keep these do's and don'ts of budgeting in mind:. Now it's your turn! Download the attached worksheet and jot down your answers to the questions above.

Before you know it, you'll have brainstormed and outlined your budget.

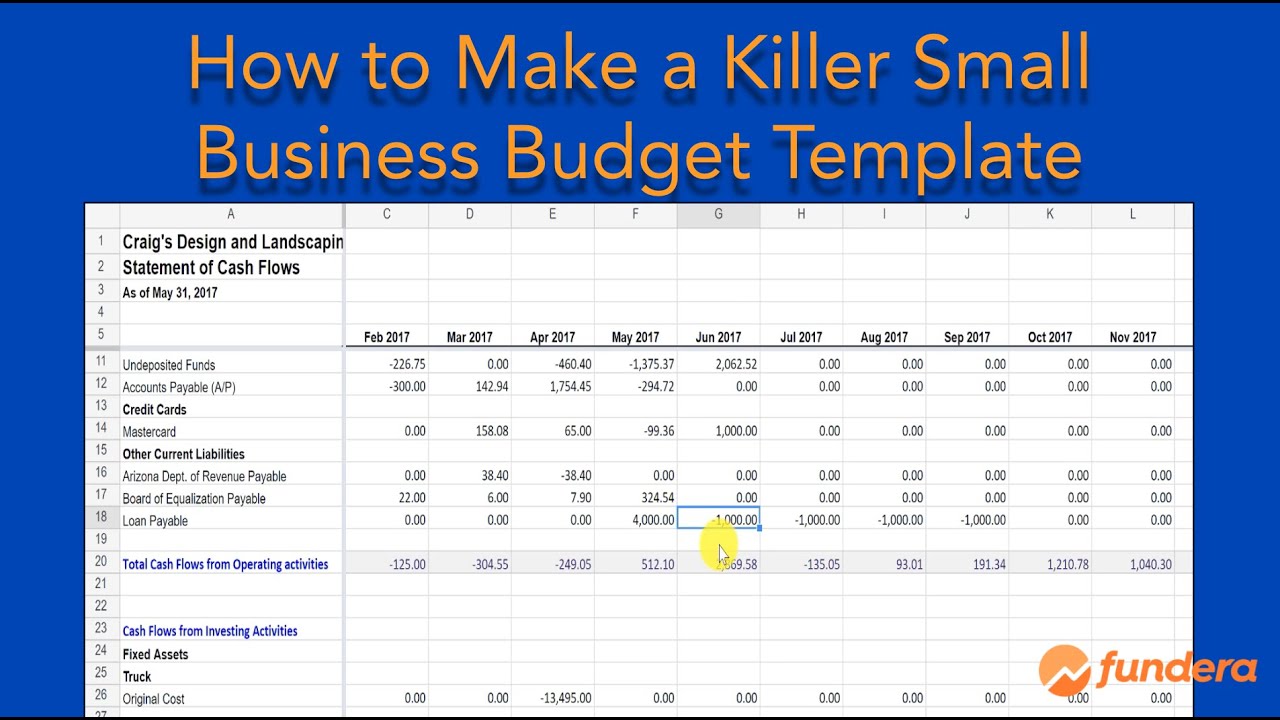

How to Create a Cash Budget for a Business Plan in Excel by Paul Borosky, MBA.

, time: 18:28Components of a Business Budget. Again, a business budget is a key piece of your business plan (which you'll learn about more in the next course). It helps you determine how much money you need from investors and helps you prioritize your objectives. Components of a business budget you should think about include Benefits of a business budget. manage your money effectively. allocate appropriate resources to projects. monitor performance. meet your objectives. improve decision-making. identify problems before they occur - such as the need to raise finance or cash flow difficulties. plan May 13, · Make a list of your fixed expenses. These ones repeat every month and their amount doesn’t change. Some people forget to exclude the sum needed to cover these expenses from the monthly income, but it’s important to do so in order to get a clear understanding of your budget. Don’t forget about variable blogger.comted Reading Time: 9 mins

No comments:

Post a Comment